Risk Profile and Assessment

At Top Rho, we understand that identifying and managing risks is crucial for the success and sustainability of our business. Our risk profile and assessment process help us to:

- Identify potential threats and opportunities

- Making informed decisions about risk mitigation strategies and resource allocation

- Minimizing potential losses and maximize benefits

- Ensure the long-term sustainability of our business

Our Risk Profile

Our risk profile includes a combination of financial, operational, strategic, compliance and reputation risks. We regularly review and update our risk profile to ensure that it remains relevant and effective

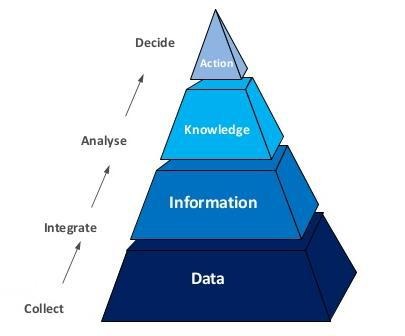

Risk Profile Process

Data Gathering

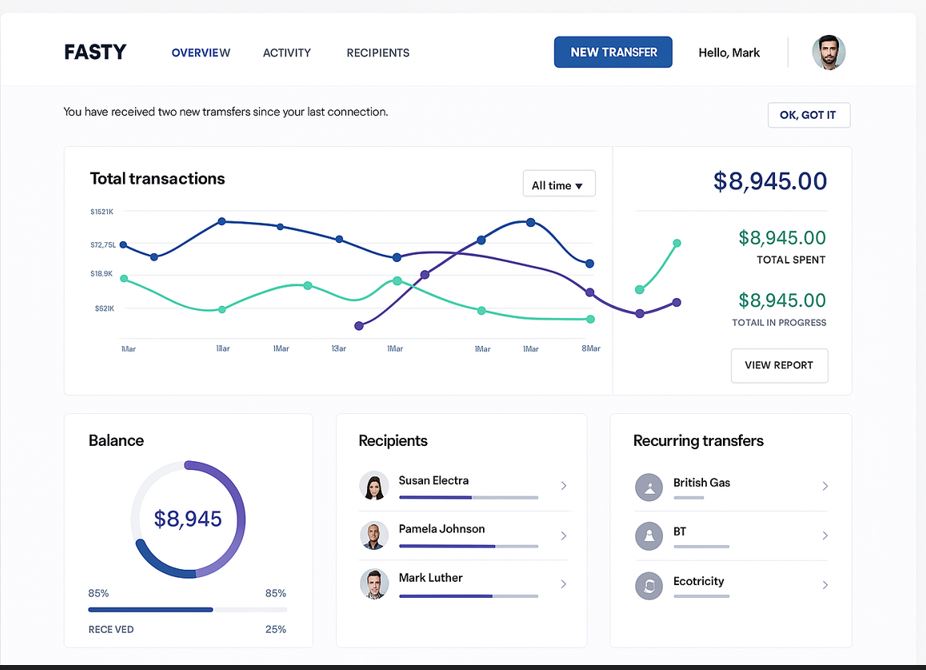

We collect and analyze your financial statements, operational data, and industry trends.

Risk Identification

Goal

To assess the main threats to your businesses

- Assets

- Earning Capacity

- Overall Success

We pinpoint potential threats across various categories, including:

o Credit Risk: The possibility of customers or vendors failing to meet payment obligations.

o Liquidity Risk: The inability to meet short-term financial commitments due to cash flow issues.

o Market Risk: Losses arising from fluctuations in interest rates, currency exchange rates, or stock prices.

o Operational Risk: Disruptions to daily operations due to internal factors like human error or technology failures.

o Strategic Risk: Threats arising from external factors like changes in customer preferences, regulations, or technological advancements.

Risk Analysis

We assess the likelihood of each risk occurring and the potential financial impact if it materializes.

Risk Prioritization

We prioritize risks based on their severity and likelihood, allowing you to focus on the most critical threats first.

Risk Mitigation Strategies

We evaluate and suggest the best solutions out of

- Risk Acceptance

- Risk Transfer

- Risk Reduction

- Risk Elimination

We collaborate with you to develop customized plans to mitigate identified risks. This might involve implementing stricter credit control policies, building cash reserves, diversifying investments, or acquiring appropriate insurance coverage.

Benefits of a Professional Risk Assessment

While you can conduct a basic risk assessment yourself, a professional assessment from Top Rho offers several advantages:

Expertise

Our team has extensive experience in identifying and analyzing financial risks specific to SMEs.

Objectivity

We provide an unbiased perspective on your financial situation.

Structured Approach

We follow a proven methodology to ensure a comprehensive assessment.

Actionable Insights

We translate complex financial risks into practical recommendations for your business.